Retirement Plans in Canada

On Mondays, what do you call someone who is cheerful? Retired. While you’re daydreaming about the day when you won’t have to clock in every day, keep in mind that retirement isn’t about what age you want to retire; it’s about what income you want to retire at. To create your retirement strategy, you’ll need a financial strategy for saving and investing your earnings until they can pay your expenditures when you retire.

Canadians can plan and save for retirement in a variety of ways. Here are some resources to help you grow your savings.

List of best Retirement Plans in Canada

Registered Retirement Savings Plan (RRSP)

The Registered Retirement Savings Plan (RRSP) is a popular tax-sheltered retirement savings plan for Canadians under the age of 71 who have earned an income and filed a tax return in order to accumulate RRSP contribution capacity. Your contribution room is calculated using 18% of your previous year’s earned income, up to a maximum contribution limit set for the tax year. You can carry forward any unused contribution room indefinitely.

Tax-Free Savings Account (TFSA)

A tax-free savings account is a very flexible tax-advantaged account that can be used to put money aside for the future. Consider it more than a high-interest savings account for an emergency fund, as its name suggests. Anyone over the age of 18 with a valid social insurance number (SIN) can invest in stocks, bonds, ETFs, and other investments through their TFSA. TFSA donations, unlike RRSP contributions, are made after-tax money and are not tax deductible.

The Canada Pension Plan (CPP)

The Canada Pension Plan is a taxed monthly retirement benefit that can help augment your income when you retire. You must be at least 60 years old and have made at least one valid CPP contribution to be eligible to apply for and receive benefits from the plan. You will receive the CPP retirement pension for the rest of your life if you qualify.

Old Age Security (OAS)

Old Age Security is a taxable monthly payment programme for seniors in Canada that is funded by general tax revenue. You must be at least 65 years old, a Canadian citizen or legal resident at the time your OAS application is granted, and have lived in Canada for at least 10 years since the age of 18 to be eligible for payments. When you turn 64, Service Canada will send you a letter confirming your enrollment. You’ll have to apply if you don’t receive the letter.

You must have lived in Canada for 40 years to obtain the maximum payment ($615.37 per month in 2021). You can still get a partial benefit if you haven’t resided in Canada long enough to be eligible for the maximum amount.

Guaranteed Income Supplement (GIS)

The Guaranteed Income Supplement (GIS) is a non-taxable monthly benefit for low-income seniors. In most situations, you’ll receive a letter from Service Canada the month following you turn 64 informing you that you’ve been enrolled. You’ll have to apply if you don’t receive the letter. Single, widowed, or divorced seniors might receive up to $919.12 per month in 2021. As you make more money, this amount decreases until it disappears after your income hits $18,648. If you have a spouse or common-law partner, you may be eligible for additional GIS supplements.

Employer-sponsored Pension Plans

A qualified employer pension plan might provide you with a source of income after retirement. A defined benefit plan and a defined contribution plan are the two basic forms of employer pension plans. If your employer offers one of these alternatives, take advantage of the opportunity to boost your future earnings.

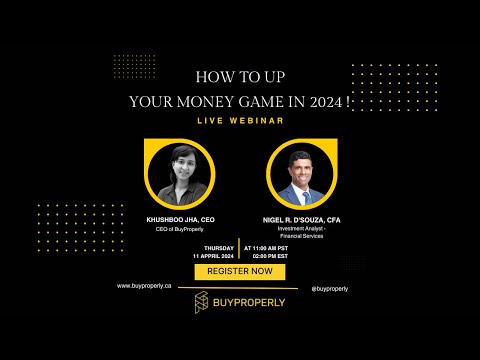

Are you looking to make your first (or next) real estate purchase? We employ innovative AI technology at BuyProperly to assist match investors with attractive investment options. We use a fractional ownership concept, which means you can get started for as low as $2500 (and expect yearly profits of 10-40%). BuyProperly’s methodology makes it simple to diversify your investment portfolio and grow wealth by allowing you to invest in multiple properties and locations. Do you want to know more? Pay us a visit at buyproperly.ca/properties.

Related Topics: