What Is the Canada Pension Plan (CPP)?

Retirement planning, in its most basic form, is the process of preparing for life after paid labor, not only financially, but in all areas of one’s life. Lifestyle decisions such as how to spend time in retirement, where to live, and when to retire altogether are non-financial concerns.

In a holistic approach to retirement planning, all of these aspects are taken into account. The significance of retirement planning varies according to one’s age. Retirement planning begins early in a person’s career and comprises setting aside sufficient funds for retirement. Setting specific income or asset objectives and taking steps to achieve them in the midst of your career is another example.

Now let’s understand what is The Canada Pension Plan (CPP) Retirement Plan:

The Canada Pension Plan is one of three levels of the Canadian government’s retirement income scheme that pays out retirement and disability benefits. The Canada Pension Plan was formed in 1965 to provide retirees and handicapped contributors with a basic benefits package. Survivors receive the benefits granted by the plan if the recipient dies.

The Canada Pension Plan (CPP)

The Canada Pension Plan is a taxed monthly retirement benefit that can help enhance your income when you retire. You must be at least 60 years old and have made at least one valid CPP contribution to be eligible to apply for and receive benefits from the plan. You will receive the CPP retirement pension for the rest of your life if you qualify.

The amount you receive from the CPP is determined on the amount you contributed, the length of time you contributed, and when you chose to begin receiving payments. While the greatest amount you can receive is $1,203.75, the average amount received by Canadians is $689.17 due to a variety of factors that influence the government’s assessment. Most CPP recipients receive significantly less than the maximum payout, with the average being around 60%, so budget accordingly.

Stages of Retirement Planning

The following are some tips for successful retirement planning at various phases of life.

Young Adulthood (Ages 21–35)

Those just starting out in adulthood may not have a lot of money to invest, but they do have time to let their investments mature, which is an important part of retirement planning. This is due to the principle of compound interest.

Compound interest means that interest earns interest, and the longer you have, the more interest you’ll earn. Because of compounding, even if you can just put aside $50 each month, it will be worth three times more if you start investing at age 25 than if you wait until age 45. You may be able to invest more money in the future, but you can never make up for lost time.

Early Midlife (Ages 36–50)

Mortgages, student debts, insurance premiums, and credit card debt are all common financial stresses in early middle age. At this stage of retirement planning, though, it’s vital to keep saving. These are some of the finest years for aggressive saving since you can earn more money while still having time to invest and earn interest.

Later Midlife (Ages 50–65)

Your investing accounts should grow more conservative as you get older. While time is running out to save for folks who are nearing retirement, there are a few advantages. Higher salary, as well as the possibility of having some of the aforementioned expenses (mortgages, school loans, credit card debt, and so on) paid off by this time, can provide you more money to invest.

It’s also never too late to open and fund a 401(k) or an IRA. Catch-up contributions are one of the advantages of this stage of retirement preparation. In 2021 and 2022, you can contribute an additional $1,000 per year to your regular or Roth IRA and $6,500 per year to your 401(k) starting at age 50.

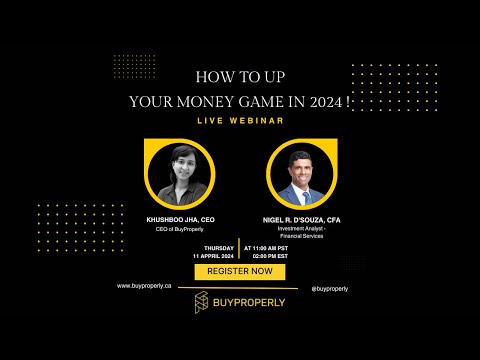

Are you looking to make your first (or next) real estate purchase? We employ innovative AI technology at BuyProperly to assist match investors with attractive investment options. We use a fractional ownership concept, which means you can get started for as low as $2500 (and expect yearly profits of 10-40%). BuyProperly’s methodology makes it simple to diversify your investment portfolio and grow wealth by allowing you to invest in multiple properties and locations.

Related Articles to Canada Pension Plan (CPP):