What Is Diversification in Investing?

Diversification is a risk-reduction strategy that spreads investments over a variety of financial instruments, industries, and other categories. Its goal is to maximise profits by investing in a variety of sectors that will react differently to the same event.

Although diversification does not guarantee against loss, most investing professionals agree that it is the most crucial component of achieving long-term financial goals while limiting risk.

Understanding Diversification in Investing

Assume you have a portfolio that consists solely of airline stocks. Any negative news, such as an indefinite pilot strike that will result in flight cancellations, may cause stock values to fall. This implies that the value of your portfolio will drop.

You can offset these equities with a few railway stocks, ensuring that just a portion of your portfolio is impacted. In fact, when passengers seek alternative forms of transportation, there is a significant possibility that these stock values will climb.

Because of the risks involved with these companies, you may diversify even further. That’s because anything that has an impact on travel will have a negative impact on both businesses. Rail and air stocks may have a high link, according to statisticians. This implies that you should diversify across industries as well as different sorts of businesses. The higher the degree of uncorrelation between your equities, the better.

Diversify your portfolio across asset types as well. Bonds and stocks, for example, do not react to negative occurrences in the same manner. Because stocks and bonds move in opposite directions, combining them in your portfolio will lessen your portfolio’s sensitivity to market movements. As a result, diversifying your portfolio will counter any negative movements in one area with positive outcomes in another. Not to mention the importance of location. Look for opportunities outside of your immediate area.

How Many Stocks You Should Have

Obviously, holding five stocks is preferable to owning one, but there comes a point at which adding more equities to your portfolio is no longer beneficial. The number of stocks required to decrease risk while retaining a high return is a source of debate. According to the most widely held belief, an investor can achieve optimal diversification by owning merely 15 to 20 equities diversified over a variety of industries.

Different Types of Risk

When it comes to investing, there are two categories of risk that investors must consider. The first is what is referred to as systematic or market risk. Every business is exposed to this type of risk. Inflation, exchange rates, political instability, conflict, and interest rates are all common factors. This type of risk isn’t unique to any company or industry, and it can’t be avoided or mitigated through diversification. It is a type of risk that must be accepted by all investors.

Diversifiable or unsystematic risk is the second form of risk. A company, industry, market, economy, or country faces this risk. Business risk and financial risk are the most common sources of unsystematic risk. Because it is diversifiable, investors can lower their risk by diversifying their holdings. As a result, the goal is to invest in a variety of assets so that market shocks do not influence them all equally.

What Does Diversification Mean in Investing?

Diversification is a risk-mitigation and return-maximizing technique that involves allocating investing assets among a variety of vehicles, industries, firms, and other categories.

What Is an Example of a Diversified Investment?

Different asset types, such as stocks, bonds, and other assets, are included in a diversified investment portfolio. That’s not all, though. These vehicles diversify their portfolios by purchasing stock in a variety of companies, asset classes, and industries. A diversified investor’s portfolio, for example, might include equities from retail, transportation, and consumer staples companies, as well as corporate and government bonds. Money market accounts and cash can be used to diversify further.

What Happens When You Diversify Your Investments?

In order to maximize your returns, diversify your investments to limit the amount of risk you’re exposed to. Although certain risks, such as systemic risks, cannot be avoided, unsystematic risks, such as commercial or financial risks, can be hedged against.

The Bottom Line

Diversification can aid in risk management and decrease the volatility of an asset’s price changes. However, keep in mind that risk can never be totally avoided, no matter how well diversified your portfolio is.

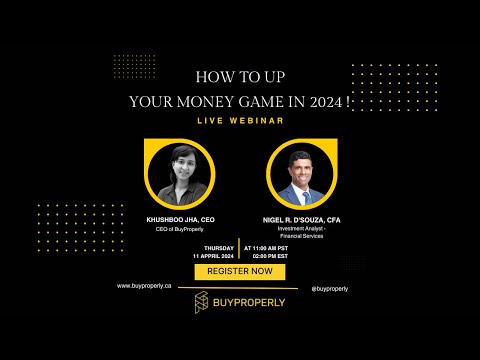

We’ve streamlined a procedure that was previously complex, time-consuming, and costly. We locate and gain the greatest properties using our industry expertise and AI technology, resulting in top-performing rental properties and fantastic investment prospects for you to develop your wealth. Take a look at our properties.

Related Articles to Current Assets