What Is a High-Ratio Loan?

A high-ratio loan is one in which the loan value exceeds the value of the property used as security. Mortgage loans with high loan ratios have a loan value that is close to 100 % of the property’s value. A borrower who is unable to make a big down payment may be approved for a high ratio loan.

In the case of mortgages, a high ratio loan is one in which the loan value surpasses 80% of the property’s value. The loan-to-value (LTV) ratio is a metric used by financial institutions to analyse the risk of lending before approving a mortgage.

The Formula for a High-Ratio Loan using LTV.

Although there is no specific technique for calculating a high ratio loan, investors should first assess their loan-to-value ratio to see if it exceeds the 80% LTV threshold.

Loan to Value Ratio = Mortgage amount/Appraised property value

How to Calculate a High-Ratio Loan Using LTV

- The LTV ratio is computed by dividing the loan amount by the property’s appraised value.

- To convert the value to a percentage, multiply it by 100.

- A loan is termed a high ratio loan if the loan value after your downpayment surpasses 80% of the LTV.

What Does a High LTV Ratio Loan Tell You?

The LTV ratio is used by lenders and financial providers to assess the level of risk involved in making a mortgage loan. A high ratio loan is one in which the borrower is unable to make a substantial downpayment and the loan value approaches the appraised value of the property. To put it another way, as the loan value approaches 100% of the property value, lenders may deem the loan too risky and decline the application.

Borrower default is a danger for the lender, especially if the LTV is excessively high. The bank may not be able to sell the property for enough money to repay the defaulted borrower’s debt. During an economic crisis, when housing properties often lose value, such a scenario is very likely to occur. The loan is said to be underwater if the amount borrowed exceeds the value of the property. The bank will lose money if the borrower defaults on the mortgage and the property is sold for less than the outstanding mortgage balance. To avoid such a loss, banks keep an eye on LTV.

As a result, in order to protect the lender, most high-ratio house loans include some sort of insurance coverage. Private mortgage insurance (PMI) is a type of insurance that the borrower must acquire separately to help safeguard the lender.

Example of a High-Ratio Loan

Let’s say a borrower wants to buy a home with an appraised value of $100,000. The borrower can only afford a $10,000 down payment and will have to borrow the rest $90,000. After pursuing a number of lenders, one eventually agrees to underwrite a loan, but at a higher-than-average interest rate.

The result is a 90 percent loan-to-value ratio (90,000 / 100,000), which is termed a high ratio loan.

High-Ratio Loans vs. Home Equity Loans

A home equity loan, sometimes known as a second mortgage, is a type of instalment loan that allows homeowners to borrow against the equity in their property. The loan is based on the difference between the homeowner’s equity and the current market value of his or her home.

A home equity loan is for borrowers who already have a mortgage and have paid off a portion of it, but whose property worth exceeds their loan total. To put it another way, a home equity loan allows homeowners to borrow money against the value of their home. A high-ratio loan, on the other hand, can have a loan value that is close to 100% of the property’s value.

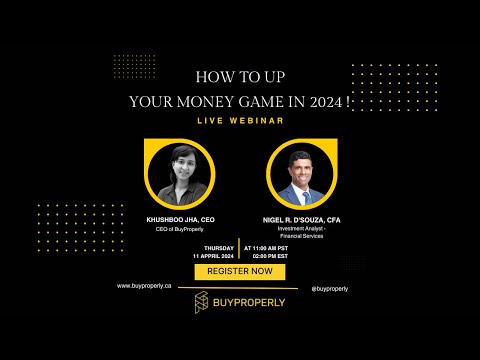

While stock market trading may be dangerous, and real estate investing can be time-consuming, BuyProperly combines the best of both worlds. BuyProperly is a fractional real estate company that lets anyone with just $2500 participate in real estate. This novel idea is similar to stock investment but without the hassles of real estate ownership. Are you ready to begin investing? Contact us today!

Related Topics to High-Ratio Loan: