There is no doubt that investing in real estate is a smart move for anyone looking to secure their financial future. But when it comes to building a lucrative real estate portfolio, there are a few different options to choose from.

One of the most popular choices is investing in single-family homes. In this blog post, we will take a look at the pros and cons of investing in single-family homes and help you decide if this is the right type of investment for you!

First, let’s define the main types of residential investments:

Single-family: A property that has one available dwelling to rent.

Duplex: A property that has two available dwellings to rent.

Multi-family: A property that has 3 or more available dwellings to rent.

Let’s start by looking at all the pros of investing in single-family homes.

High Returns

Single-family homes are a great choice if you’re looking for steady appreciation with a good return on investment.

In most cases, you can expect to make around 12% on your investment each year. Don’t forget you’ll have maintenance and operating expenses and potentially regular mortgage payments as well which we’ll discuss in a moment.

That’s a pretty good chunk of change! And remember, investing in real estate isn’t just about getting rich quick; it’s about investing for the future.

If you plan on holding onto these properties indefinitely, then single-family homes are a great choice because they tend to appreciate quickly over time.

For instance, if you buy a property today for $100,000 and sell it 20 years from now for $200,000 then that’s an average of 12% appreciation per year.

If you held onto your investment property indefinitely, the value would continue to increase at this rate while other investment options (like stocks) might plateau after some time.

Easier to Get Started

Another pro of investing in single-family homes is that it is a very easy way to get started. Unlike multi-families that may require hundreds of thousands of dollars to buy in, single families are less expensive and, therefore, easier to acquire.

You don’t need a lot of money to start building your real estate portfolio and you can begin seeing returns pretty quickly.

Perhaps you don’t have enough deposit for the mortgage down payment, – then you consider the opportunity to invest a fractional share of a property. Here at BuyProperly, we help investors get started in real estate investing for as little as $2500! Learn more here.

Stable and Secure

The market for single-family homes is always growing. Even if the economy takes a turn for the worse, you can still expect to make money off of your investment. Unlike investing in stocks or other forms of investments, real estate is something that normally retains its value no matter what the market is doing.

Maintenance and Repair Costs

A big benefit of single-family investing is that repair and maintenance costs are often lower than what you would pay with larger buildings.

Instead of having multiple units to look after under a very large roof, investing in a single-family means you only have one unit (or “door”) to worry about. Plus, you can often do the repairs yourself to save even more money.

More Control

Investing in single-family homes gives you more control over your investments.

For example, if you buy a single-family home and then decide that investing isn’t right for you anymore, you can sell it at any time. You have more control over the investment and how long to continue investing. Plus, since they appreciate quickly over time with little upkeep required from an investor point of view this means less stress when investing.

Less Risk

Single-family homes are a great way to get started in real estate investing without taking on too much risk.

Why? Because, as we mentioned before, the market for single-families is always growing. This means that even if your investment doesn’t go as planned, you can still sell it down the road and make most of your money back.

Easier to Manage

Another pro of investing in a single-family home is that it is much easier to manage than a larger property. It’s often easier to find a property management company and the fees are substantially less than you would pay with a larger building. You also don’t have to worry about hiring and managing staff, which can be a big hassle.

Less turnover

Single-family rentals tend to have long-term tenants with less turnover than lower-priced units in a multi-family building. Long-term tenants are more stable and will pay their rent on time, which means less stress for you.

Multiple vacancies can become a big issue with larger properties and can really eat into your profits.

Diversification

Because single-family homes are less expensive than large buildings, it’s easier to continue investing and keep adding more homes to your real estate portfolio. This means you can diversify and reduce the risk of sudden vacancies and non-paying tenants.

As you can see, there are several pros to investing in single-family real estate! But, like any investment, it doesn’t come without some risk.

Cons of Investing in Single-Family Homes

Now that you have a good idea of the many benefits of investing in single-families, let’s take a look at some of the cons of this type of real estate investment.

Sourcing Deals

The main con of investing in single-family homes is that it can be difficult to find good deals. Because this is such a popular choice, the competition for good deals is fierce. So you need to be prepared to do some digging and put in some work if you want to make a profit.

The main con of investing in single-family homes is that it can be difficult to find good deals. Because this is such a popular choice, the competition for good deals is fierce. So you need to be prepared to do some digging and put in some work if you want to make a profit.

Takes time to generate a return

With single families, it can take a while to see a return on your investment. It’s not uncommon for it to take at least five years before you start seeing any real profits.

Remember, although you’re always able to collect rental income on your investment, much of the benefit in single-family investing comes with the capital appreciation over time.

Flip & Sell Risks

“Flipping” houses (buying and selling them quickly for a profit) can be risky – especially if you don’t know what you’re doing. If you’re not careful, you could end up losing money on a flip.

Another con to flipping is that it’s often difficult to find good deals – the same issue we mentioned before. And if you do find a good deal, there’s always the risk that someone will come in and snatch it out from under you.

If the market takes a downturn, you could end up losing money on the sale.

Vacancy rates

Unlike multi-family investing with several units or “doors” to generate income, single-family investing means you’re buying only one unit to rent. If a tenant doesn’t pay the rent or leaves the property, you could suddenly find yourself at 100% vacancy which can significantly eat into your ROI.

Management

Another downside is that it can take a lot of time and effort to manage all of the different aspects of owning and managing multiple single-family homes. Two or three properties can be extremely easy, whereas 10, 15, or even 20 single-family homes can mean a lot of traveling for your management company!

If you are planning on managing the property yourself, you’ll also need to be within a reasonable commuting time to this property to deal with any issues.

Less Leverage

Lastly, investing in a single-family home usually doesn’t provide as much leverage as investing in a larger property.

In the real estate investing world, leverage means using other people’s money to fund your investment.

For example, with single-family investing, you may only be able to get a loan for 50% or 60% of the purchase price. Whereas with investing in a larger property, you may be able to get a loan for up to 80% or even 90%.

This is because investing in larger buildings means investing more money and investing more money means investing more risk.

And the bank doesn’t want to be stuck with all the risk if something goes wrong. So, they’re more likely to loan you money when you’re investing in a larger property.

This means you can’t make as much money on your investment if it goes up in value.

Are single-family homes the right investment for you?

That all depends on your goals and what you’re looking for in an investment. If you’re prepared to do some work sourcing good deals, investing in a single-family home can be a great way to get started in real estate investing. They are stable and secure, have lower maintenance costs, and are easier to manage than larger properties.

However, keep in mind that it can take a while to see a return on your investment. So if you’re looking for something that will generate income quickly, single-family homes may not be the best option for you.

Conclusion

Overall, investing in single-family homes is a great way to secure your financial future. It is a stable investment that has the potential to make you a lot of money over time. However, it is important to remember that there are some risks involved and it does take some effort to manage everything.

If you are willing to take on these challenges, then investing in single-family homes is definitely something you should consider!

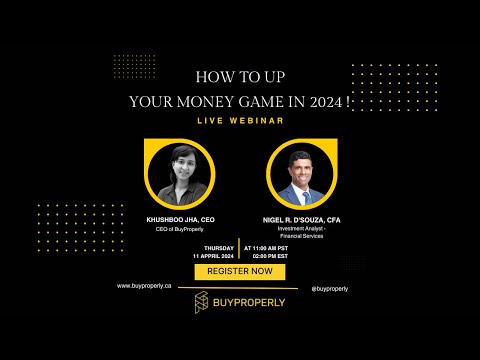

Looking for your first (or next) real estate investment? Here at BuyProperly, we use advanced AI technology to help match investors with lucrative investment opportunities. We use a fractional ownership model so you can get started for as little as $2500 (and see projected annual returns of 10-40%!). With this approach, BuyProperly makes it easy to invest in multiple properties and locations to diversify your investment portfolio and build your wealth! Want to learn more? Visit us at BuyProperly.