If you’re interested in investing in real estate but don’t have a lot of money to put down, options are still available. As you’ll see, you can absolutely purchase property with little or no money available by using some of these creative financing techniques!

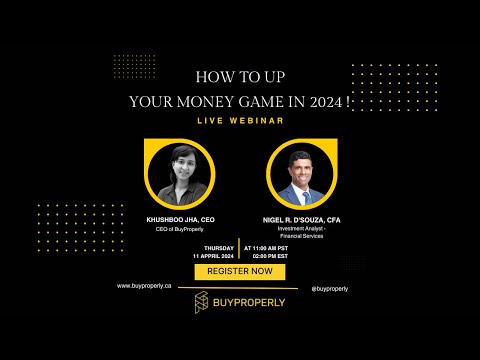

Before we dive in, have you considered fractional real estate investing? This is a new, but very attainable way to invest in real estate.

We work with investors to get started in real estate for as little as $2500! The best part? There’s no maintenance, management, or bad tenants to deal with, PLUS you can see projected annual returns of 10-40%! Learn more here.

Why alternative forms of real estate investing are becoming more popular.

In recent years, alternative forms of real estate investing have become more popular with investors who are looking to buy a property with little or no money down. This is because traditional forms of financing, such as bank loans, are becoming harder to obtain.

With house prices rising across Canada and the United States, it’s becoming increasingly more difficult for people to “buy-in” to the real estate market.

To purchase an investment property, most lenders require a 20-30% down payment. This could be anywhere from $20,000 up to $200,000 or more just for a single-family, residential property!

On top of land transfer taxes, surveys, inspections, and lawyer’s fees, these expenses are enough to push many investors out of the market.

Ongoing real estate expenses

Aside from your down payment and closing costs, investing in real estate also comes with monthly expenses. These include:

- Property taxes

- Insurance

- Maintenance and repairs

- Condo and management fees

- Mortgage payments + interest

- Rental and vacancy expenses

- Ongoing property management

This means that investors need to set aside even more money to handle monthly expenses that come up.

Is it possible to invest in real estate without having a large amount of capital available? Absolutely!

Let’s explore some of the most common ways to invest in real estate with little money.

Fractional investing

Fractional investing is a newer concept that’s gained popularity in recent years. It allows investors to pool their money together to purchase a share of an investment property.

This type of investment is often made through a real estate crowdfunding platform, which connects investors with developers who are looking to finance their projects.

With fractional investing, you can spread your investment amount over multiple properties, which also helps to mitigate risk and increase your diversification.

It’s also a great way to get started in real estate investing with little money as you can typically invest as little as $2500.

Seller financing

Another option for investors looking to buy a property with little money down is seller financing.

With this type of financing, the seller agrees to act as the bank and provide you with a mortgage. This could be in the form of an interest-only loan or a balloon payment loan.

Seller financing can be a great option for both buyers and sellers. The buyer gets to purchase the property with little money down and the seller gets their asking price for the property.

REITs

REITs, or real estate investment trusts, are another way to invest in real estate without having to put down a large amount of money. REITs are companies that own and manage income-producing properties, such as office buildings, shopping malls, apartments, and warehouses.

REITs are traded on stock exchanges and can be bought and sold just like any other stock. This makes them a liquid investment, which is ideal for investors who want to cash out quickly if needed.

Since REITs are traded on stock exchanges, they also offer the potential for growth through capital appreciation.

The downside of investing in REITs is that they’re subject to the ups and downs of the stock market. This means that your investment could lose value if the stock market declines. In addition, there are fees associated with owning a REIT and you often don’t have any transparency about the properties that you are investing in.

Lease-options

A lease option is another creative way to invest in real estate with little money down. With a lease option, you agree to lease a property from the owner for a set period.

The length of the lease will depend on the agreement between the buyer and seller, but it’s typically 1-5 years.

During the lease period, the buyer has the option to purchase the property, but they’re not obligated to do so.

Lease options are a great way to get into a property without having to put down a large amount of money. The downside is that you’re not guaranteed to purchase the property at the end of the lease period.

Wraparound mortgages

A wraparound mortgage is another financing option for investors looking to buy a property with little money down. With a wraparound mortgage, the buyer agrees to make payments on the existing loan and takes over responsibility for the property.

The buyer then charges their own tenant a higher rent amount and uses that money to make the monthly payments on the mortgage.

Wraparound mortgages can be a great way to get into a property with little money down, but they’re not without risk. If the tenant doesn’t pay their rent on time, the investor could be responsible for making the mortgage payments.

House hacking

House hacking is a strategy that allows investors to live in the property they’re purchasing while renting out the other rooms to tenants.

This is a great way to get started in real estate investing as it allows you to live in the property while someone else helps to pay the mortgage.

House hacking can be done with any type of property, but it’s most commonly done with multifamily properties, such as duplexes and triplexes.

The downside of house hacking is that it can be a lot of work. The investor is responsible for finding tenants, collecting rent, and maintaining the property.

Subject-to properties

A subject-to-property is a property that’s purchased with the existing mortgage in place.

With this type of purchase, the buyer takes over responsibility for making the monthly mortgage payments, but the seller remains on the hook for the loan.

Subject-to properties can be a great way to get into a property with little money down, but they’re not without risk. If the buyer stops making the mortgage payments, the property will go into foreclosure and the seller will be responsible for any deficiency.

Contract for deed

A contract for deed is an agreement between a buyer and seller that allows the buyer to purchase a property while making payments over time.

The buyer doesn’t take ownership of the property until the contract is paid in full.

Contracts for deeds are a great opportunity for buyers, but they’re not without risk. If the buyer stops making the payments, the seller can cancel the contract and evict the buyer from the property.

Joint ventures

A joint venture is an agreement between two or more people to work together on a specific project.

In the context of real estate investing, a joint venture is an agreement between two or more people to purchase a property and share in the profits.

Joint ventures are a great way to get into a property with little money down as they allow you to pool your resources with another person or group of people.

The downside of joint ventures is that they can be complex and there’s always the risk that one party will default on the agreement.

Crowdfunding

Crowdfunding is a way of raising money from a large group of people.

In the context of real estate investing, crowdfunding allows investors to pool their resources and invest in a property together. Although similar to a fractional model, crowdfunding focuses more on raising capital as opposed to investing in fractional shares of a property.

Crowdfunding platforms such as RealtyMogul and Fundrise make it easy for investors to get started in real estate with little money down.

The downside of crowdfunding is that it’s often a hands-off investment and you’re relying on the platform to manage the property.

Sweat equity

Sweat equity is the value of the work that you put into a property.

For example, if you purchase a fixer-upper and put in the time and effort to renovate it, your sweat equity would be the value of the renovations that you did.

Sweat equity can be a great way to get into a property with little money down since it opens up opportunities to get lower-priced properties with huge potential for appreciation. Keep in mind, if the property doesn’t appreciate in value or if the renovations take longer than expected, you could end up losing money on the deal.

Options

An option is a contract that gives the buyer the right, but not the obligation, to purchase a property at a set price within a certain period.

Options are a great way to get into a property with little money down as they allow you to control the property without having to put up all the cash for the purchase price.

The downside of options is that they can be complex and there’s always the risk that the property will decrease in value, leaving the buyer with an option that’s worth less than the purchase price.

Conclusion

There are several ways to get into real estate with little money down. The best option for you will depend on your individual circumstances.

If you’re looking for a hands-off investment, crowdfunding may be the way to go. If you’re willing to put in the work, a subject-to-property or a fixer-upper may be the best option. Fractional investing is a great option for people who want to own a piece of real estate without the headaches that come along with maintenance and management.

Whatever route you decide to take, do your research and understand the risks involved.

Ready to get started? Take a look at our properties and learn how you can get started for only $2500.